Overview of Mining Platforms

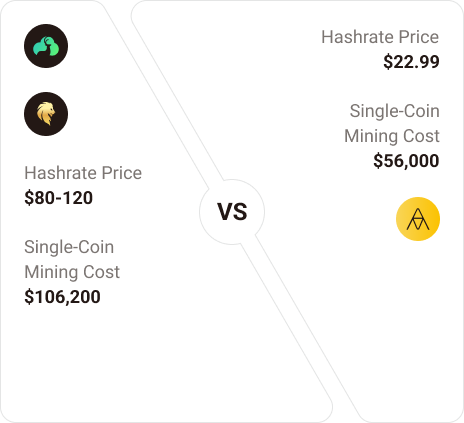

BitDeer / BitFuFu

Pricing is high. For example, the average price per TH/s for a 360-day contract is approximately $80-$120. The mining cost per BTC is ≥96% of the real-time price. Industry giants have obvious brand premiums, and retail investors' profit margins are squeezed.

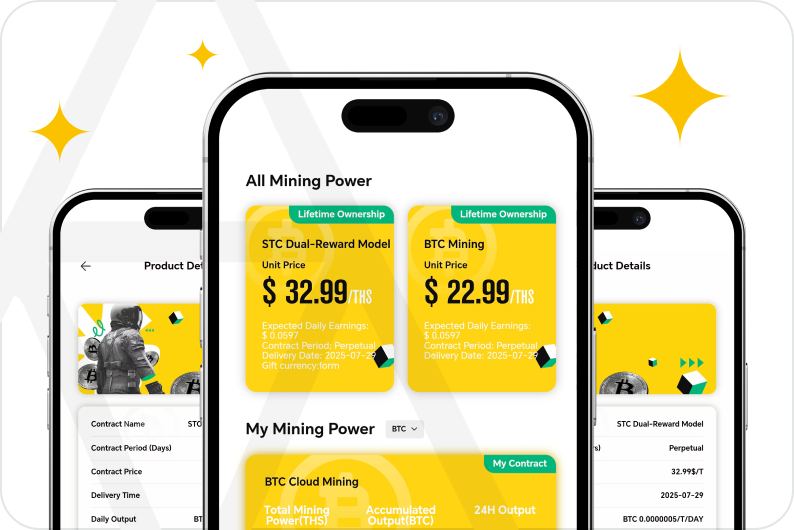

More cost-effective:The current real-time price of computing power is 1TH/s = $22.99. The cost of mining a single BTC is approximately $56,000. We provide hardware from the same top mining vendor, but through innovative partnerships and refined operations, we significantly reduce operating costs, pass more profits to users, and provide a higher return on investment. We also have a unique "dual reward model" where you invest in computing power and receive an equivalent amount of meme, providing double insurance for your income.

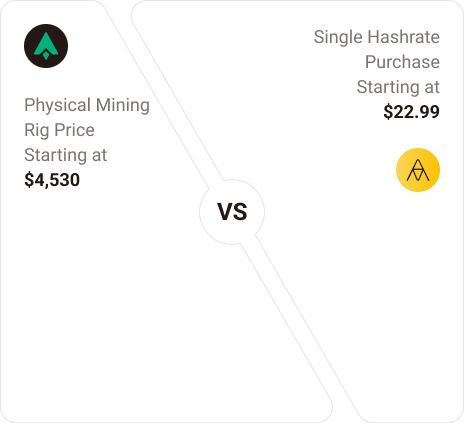

AntPool

The essence is a physical mining pool.The main physical mining machine HOST is priced at $4530, and ON-RACK is priced at $74391.82., does not directly provide scattered cloud computing products to retail investors, the threshold is high, and participation is difficult.

Service differentiation: We directly serve end users and provide flexible and diverse computing packages and a minimalist user interface.The cost of purchasing a single computing power starts at $22.99The unique dual reward model and free switching between BTC mining encapsulates complex mining pool operations into a simple "one-click mining" experience, lowering the threshold for ordinary users to participate.

Ecos

Regional risk concentration mainly servesArmeniaThe complex geopolitical environment presents concentration risks. The 50-year contracts it primarily markets and promotes are too long and have poor liquidity.

Flexibility and compliance: Flexible contract selection, dual reward model and BTC mining switching are available to meet users' diverse liquidity needs.At the same time, our physical mining machines are decentralized and distributed in Russia, North America, Northern Europe and the Middle East, making management safer and more stable.

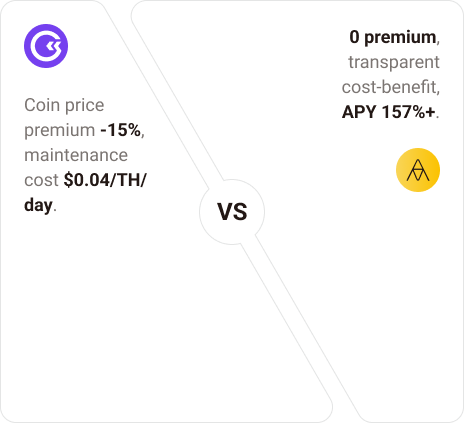

GoMining

The model is complex, the GMT token price premium in the payment system is -15%, and the maintenance cost of $0.04/TH/day is a huge hidden cost.The underlying physical mine resources are insufficiently disclosed, raising doubts about their credibility.

Entity empowerment, simple and transparent:Our advantage lies in the real physical mining farm support and clear and direct profit model. The current dual reward model STC APR is 157.22%, with an additional equivalent meme airdrop.Revenue comes directly from mining output, rather than financial derivatives, giving users greater peace of mind when investing. We focus on improving operational efficiency, rather than financial model innovation.

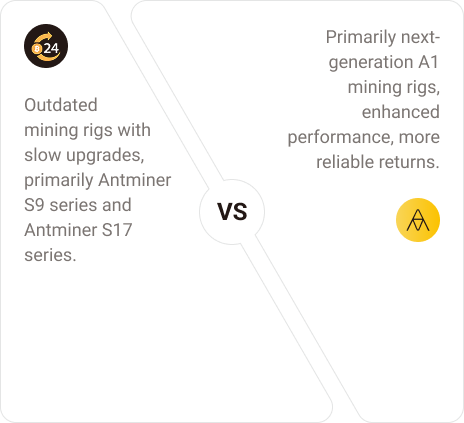

Hashing24

Slow development, lagging technology iteration, and outdated mining machine models, mainly Antminer S9 series, Antminer S17 series, T17 series, Antminer S19j Pro, Whatsminer M30S++, computing power and energy efficiency are poor.

Technology Leaders:Our mining fleet consists of the latest generation of mining machines, such as Antminer S21 Hydro, Antminer S19 XP, Whatsminer M50SThe energy efficiency ratio is far higher than the industry average, ensuring that it always maintains a leading position in the competition for computing power across the entire network.

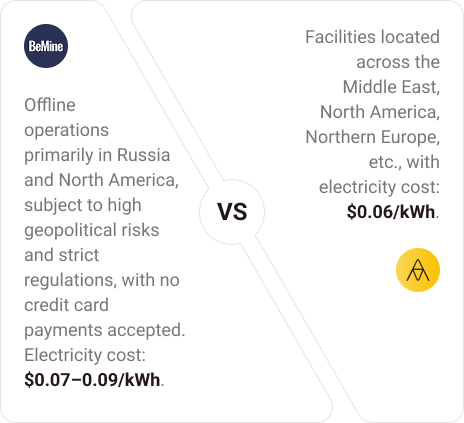

BeMine

Geopolitical risks are extremely high. Affected by international sanctions, users in most regions such as Russia and North AmericaUnable to use credit/debit card for convenient payment. The power consumption is higher$0.07 - $0.09/kWh.

Global layout: Our mines are distributed in North America, Northern Europe, the Middle East and other countries and regions with stable power resources and friendly policies. The power cost is controlled within$0.05 - $0.06/kWhThis not only guarantees user benefits, but also improves business continuity and stability, serving global users.

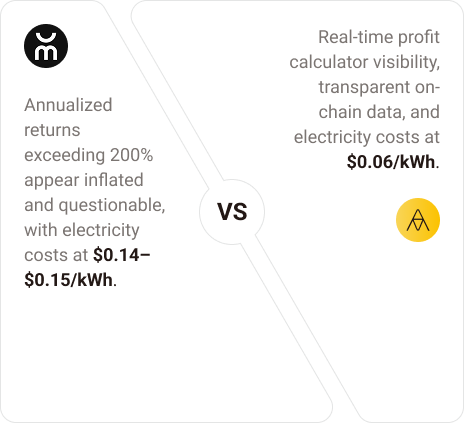

Miners.Club

Extremely opaque information, poor reputation, and high risk.The official APY of 200% is questionable, and the electricity cost reported is as high as$0.14 - $0.15/kWh.

A model of security and transparency:We provide real-time monitoring videos of mining farms and daily public on-chain revenue data. The electricity cost is more than twice that of Miners.It also uses multi-signature cold wallet technology to manage user assets, and its security is comparable to the standards of listed companies.

Quickly understand AlphaMining's core competitiveness

1. Ultimate electricity cost advantage

- Comparison: The industry average electricity cost is approximately $0.07-$0.12/kWh. Companies like BitDeer have higher electricity prices due to their brand and operating costs.

- Our advantage: By signing long-term power purchase agreements (PPAs) with large-scale renewable energy power plants (hydropower, wind power, and solar power) in North America and Northern Europe, we maintain a stable electricity cost range of $0.03-$0.05/kWh. This is our core cost barrier, ensuring higher user returns.

2. Top energy efficiency and mining hardware

- Comparison: In contrast, many platforms (such as Hashing24) still have a mix of old, energy-intensive mining machines, which reduces overall profitability.

- Our advantage: We insist on deploying the latest generation of mining machines A1 series for more than 90%This means that with the same electricity consumption, we can produce more computing power and mine more Bitcoins, and our profitability per unit of computing power is industry-leading.

3. Computing power stability and authenticity

- Comparison: Some platforms are suspected of "overselling computing power" or using virtual computing power.

- Our advantage: We promise that each of the computing power we sell corresponds to a real and latest mining machine.Live broadcast of the mine, verify the operating status of its computing power and mining efficiency at any time, and completely eliminate "air computing power".

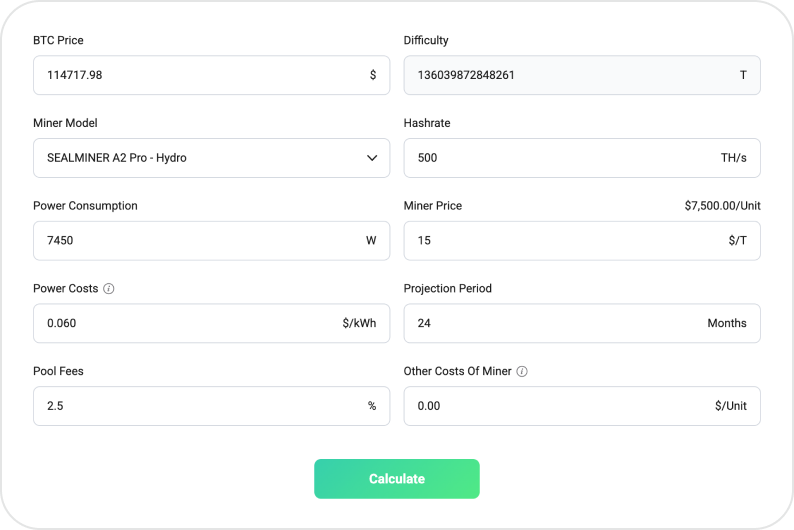

4. Double Reward Profit Model and payback cycle

- Comparison: The industry's average static return cycle is 18-24 months (hugely affected by currency prices).

- Our advantage: A dual-reward model allows you to simultaneously acquire computing power with a single click and receive an equivalent meme airdrop. Trade at any time to earn more cryptocurrency, with a payback period as fast as 513 days, providing double insurance for returns. Furthermore, thanks to ultra-low electricity costs and top-tier mining rigs, our expected payback period is significantly shortened. At the same coin price, our model indicates a 25%-35% reduction compared to the industry average. We provide a clear and transparent earnings calculator for daily earnings at a glance, with no hidden fees.

5. Excellent security protection

- Comparison: Platform asset security is one of users' biggest concerns.

- Our advantage: We use institutional-grade digital asset custody solutions.

Revenue distribution: Daily mining revenue is automatically distributed to user sub-accounts.

Revenue distribution: Daily mining revenue is automatically distributed to user sub-accounts.

Withdrawal security: User withdrawals are processed by a multi-signature cold wallet and must be physically confirmed by at least three authorized personnel, completely eliminating the risk of single-point hacker attacks.

Withdrawal security: User withdrawals are processed by a multi-signature cold wallet and must be physically confirmed by at least three authorized personnel, completely eliminating the risk of single-point hacker attacks.

Data security: All user data is fully SSL encrypted, and we work with top security auditing companies to conduct regular penetration tests.

Data security: All user data is fully SSL encrypted, and we work with top security auditing companies to conduct regular penetration tests.

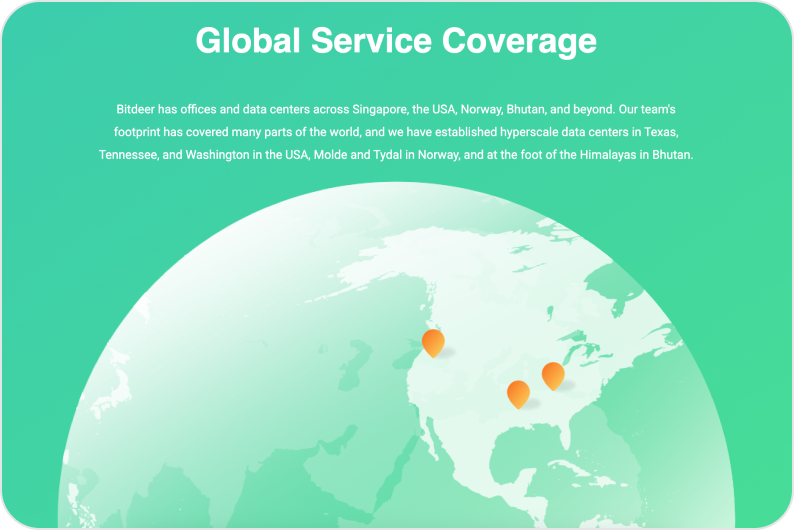

6. Global business coverage and localized services

- Comparison: Most platforms mainly serve a single region (such as BeMine serves the Russian region), and customer service response is slow.

- Our advantage: We offer a multilingual user interface in English, Japanese, Korean, Chinese, Russian, and Spanish, along with 24/7 community support. Our business structure allows users in most countries to easily purchase our services using fiat or cryptocurrency.

7. Future potential and innovation

- Comparison: The traditional platform model is solidified.

- Our advantage: We are currently testing an AI-powered peak-shaving system, which reduces power consumption during peak electricity prices and operates at full capacity during off-peak periods to further maximize returns. Furthermore, we have a roadmap for RWA (Real World Asset) and plan to tokenize our hashrate contracts in the future, providing users with unprecedented asset liquidity. This will be a more advanced form of computing than the GoMining NFT model.

Summary of AlphaMining

In the cloud computing industry full of noise andcompeteIn a risky market, AlphaMining is committed to becoming "the user's preferred secure, efficient, and transparent mining platform." We are not simply another hashrate vendor. Instead, through deep integration of upstream energy and hardware resources and the application of technological innovation, we provide global investors with a Bitcoin asset allocation tool with higher returns, more manageable risks, and a smoother experience. We welcome you to compare AlphaMining with any other platform; we firmly believe that, under equal conditions, our product has a significant advantage.