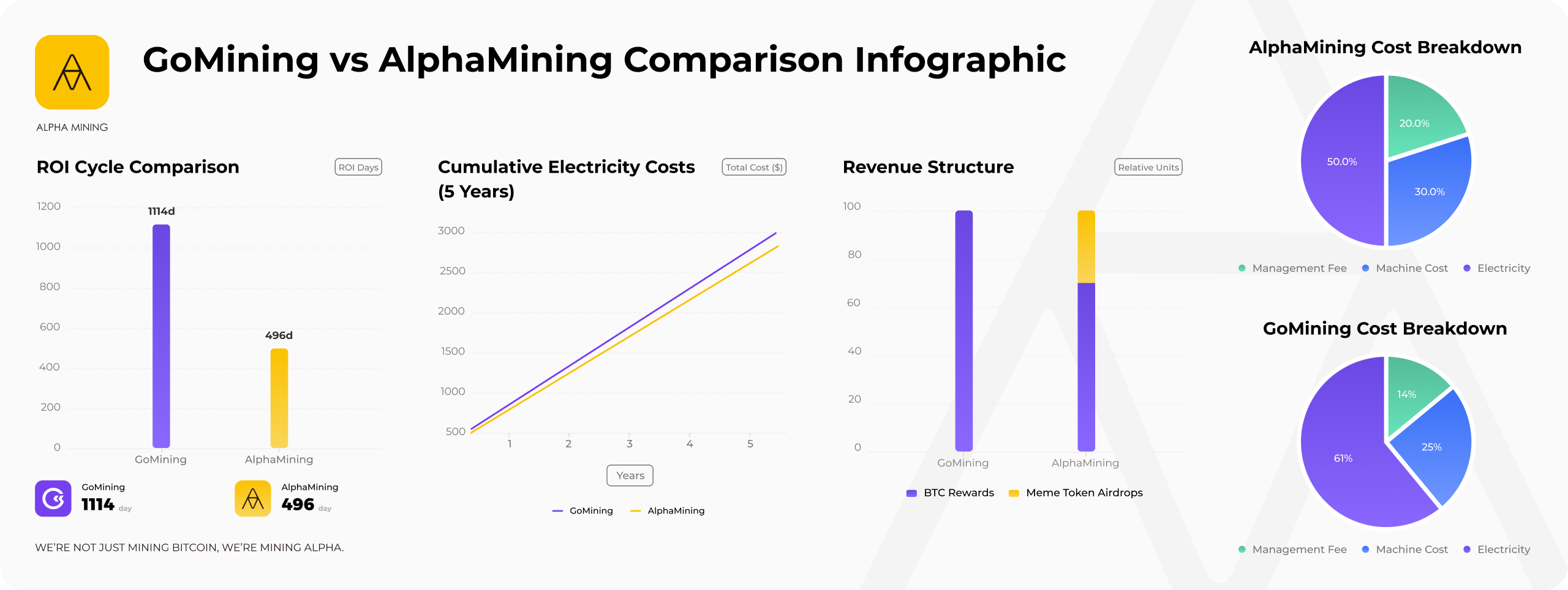

GoMining vs AlphaMining

Product Comparison & Analysis

Dissecting the Models from Electricity Costs to Service Design

1. Electricity Costs: Small Differences, Big Long-Term Impact

GoMining's electricity rate is $0.0625/kWh, while AlphaMining comes in slightly lower at $0.06/kWh.

Although the difference appears marginal, in mining — where electricity accounts for over 60% of operating expenses — it compounds significantly over time. For a single machine running 8,760 hours per year, AlphaMining saves about $43.8 annually. At scale, these savings grow exponentially, creating a long-term cost moat that converts every kilowatt-hour into more efficient profit.