AlphaMining Advantage Analysis

Differentiated Competitiveness vs BeMine

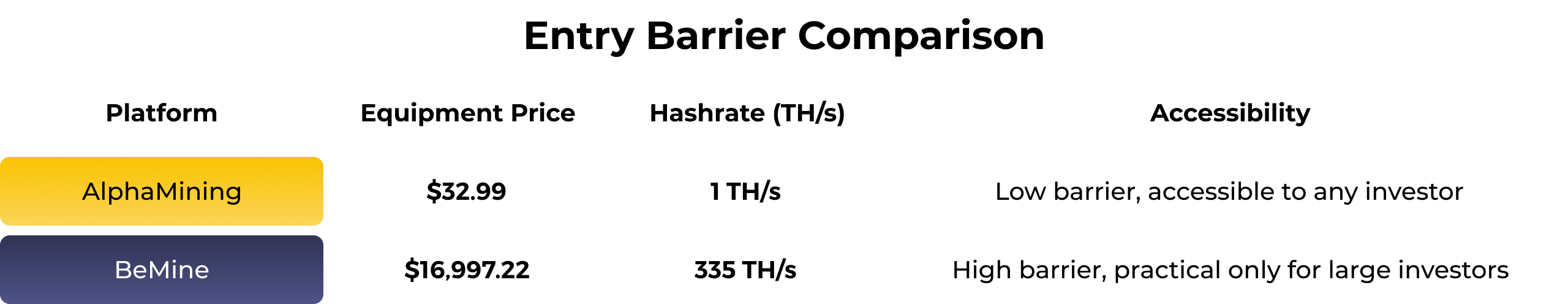

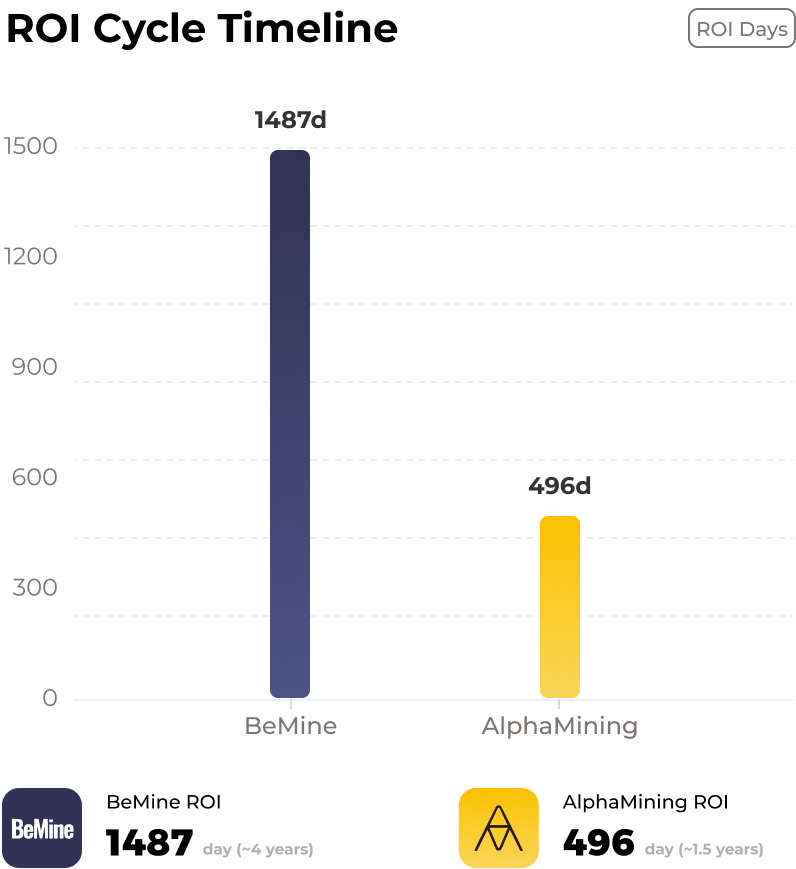

In the competitive landscape of cryptocurrency mining platforms, AlphaMining and BeMine demonstrate two entirely different operating logics. By analyzing cost structures, ROI cycles, ecosystem incentives, and risk adaptation, AlphaMining's differentiated advantages become clear — offering unique value to miners with varying needs.