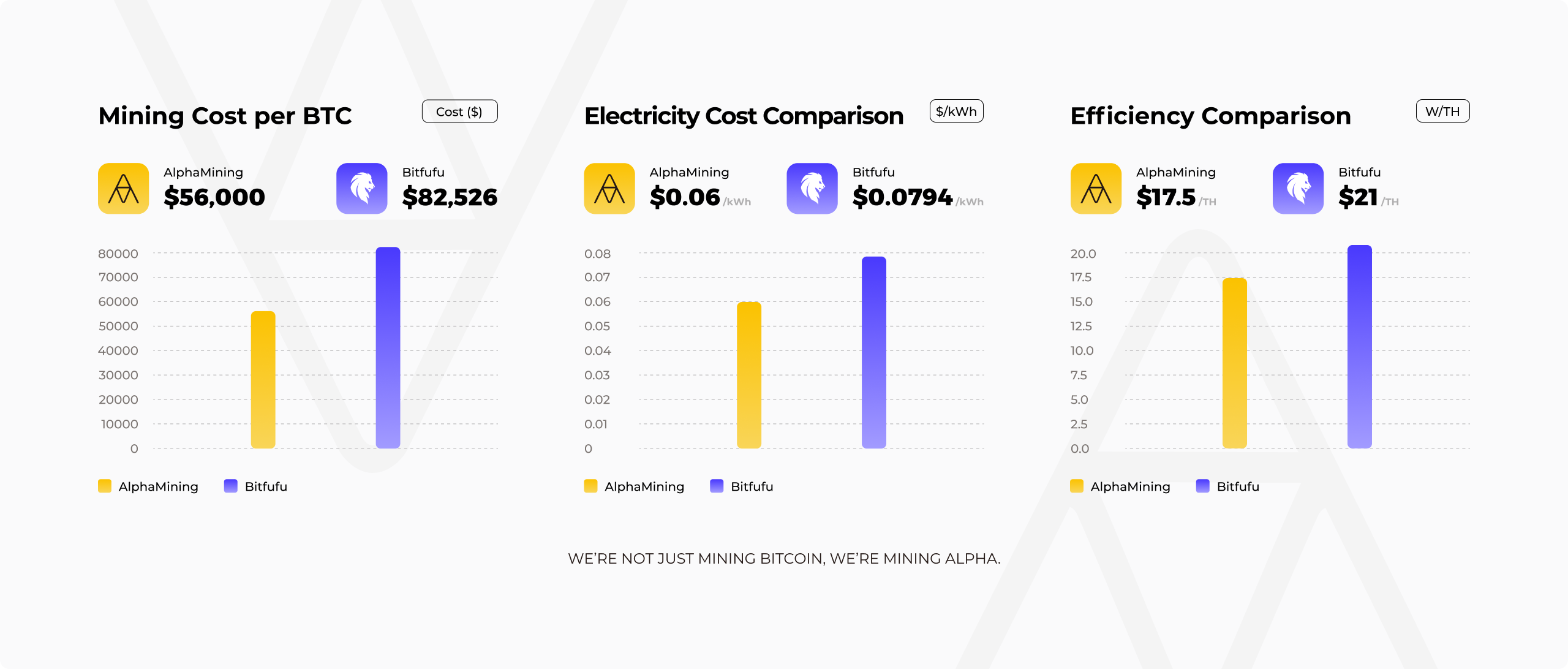

Bitfufu vs AlphaMining

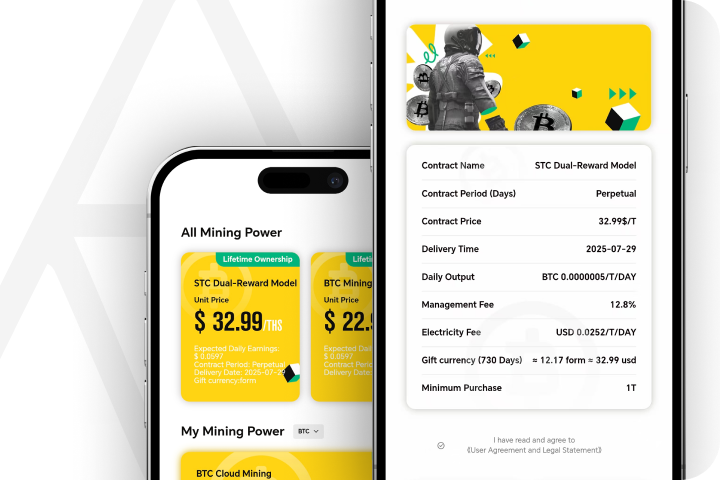

Product Comparison & Analysis

From Mining Hardware Specs to Operational Models – A Full Breakdown

1. Background

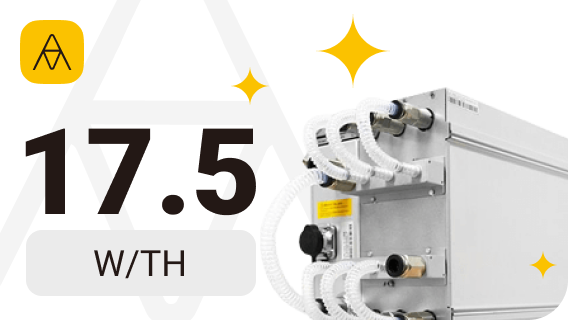

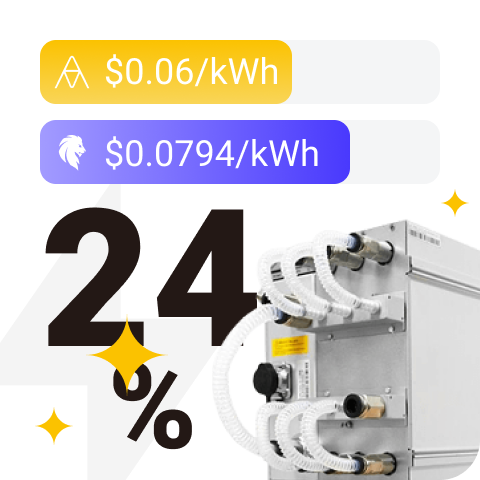

Competition in the cryptocurrency mining sector is intense. Bitfufu focuses on traditional high-hashrate leasing, while AlphaMining breaks through with a light-asset, innovation-driven model.

By dissecting the differences, we can pinpoint where each platform fits best – offering valuable insight for investor decisions and industry model innovation.